Young people in Sarawak should be the main characters in their life stories: making decisions, taking risks, and building the future they want.

However, many continue to face challenges with one essential skill: managing their finances wisely.

Mounting debts, reckless spending, and bankruptcy have become alarming trends among Malaysia’s younger population.

According to the Malaysian Department of Insolvency (MDI), approximately 5,272 bankruptcy cases among Malaysians under 34 from 2020 to 2025, including roughly 877 in 2024 alone.

Given Sarawak’s ongoing investments in youth and education, these numbers highlight that financial literacy must be treated as a core life skill, not an afterthought.

Understanding Financial Literacy

Financial literacy is defined as the integration of awareness, knowledge, skills, attitudes, and behaviours that enable individuals to make informed financial decisions and achieve financial stability.

It combines financial understanding with real-world application, such as managing monthly income, preventing high-interest debt, and building long-term savings plans.

According to the Organisation for Economic Co-operation and Development (OECD) in its 2020 International Survey of Adult Financial Literacy, only one in three adults worldwide possesses adequate financial literacy, with those aged 18–29 ranking the lowest in both knowledge and behaviour.

This trend suggests that tech-savvy youth are not always money-smart.

The Growing Challenge Among Youth

Bank Negara Malaysia disclosed that Malaysia’s household debt-to-GDP ratio reached about 84% by the end of 2023, ranking among the highest in Asia.

Though this indicates wider access to financing, it also underscores a concerning trend: many young adults rely on credit cards, personal loans, or hire-purchase schemes despite lacking financial stability.

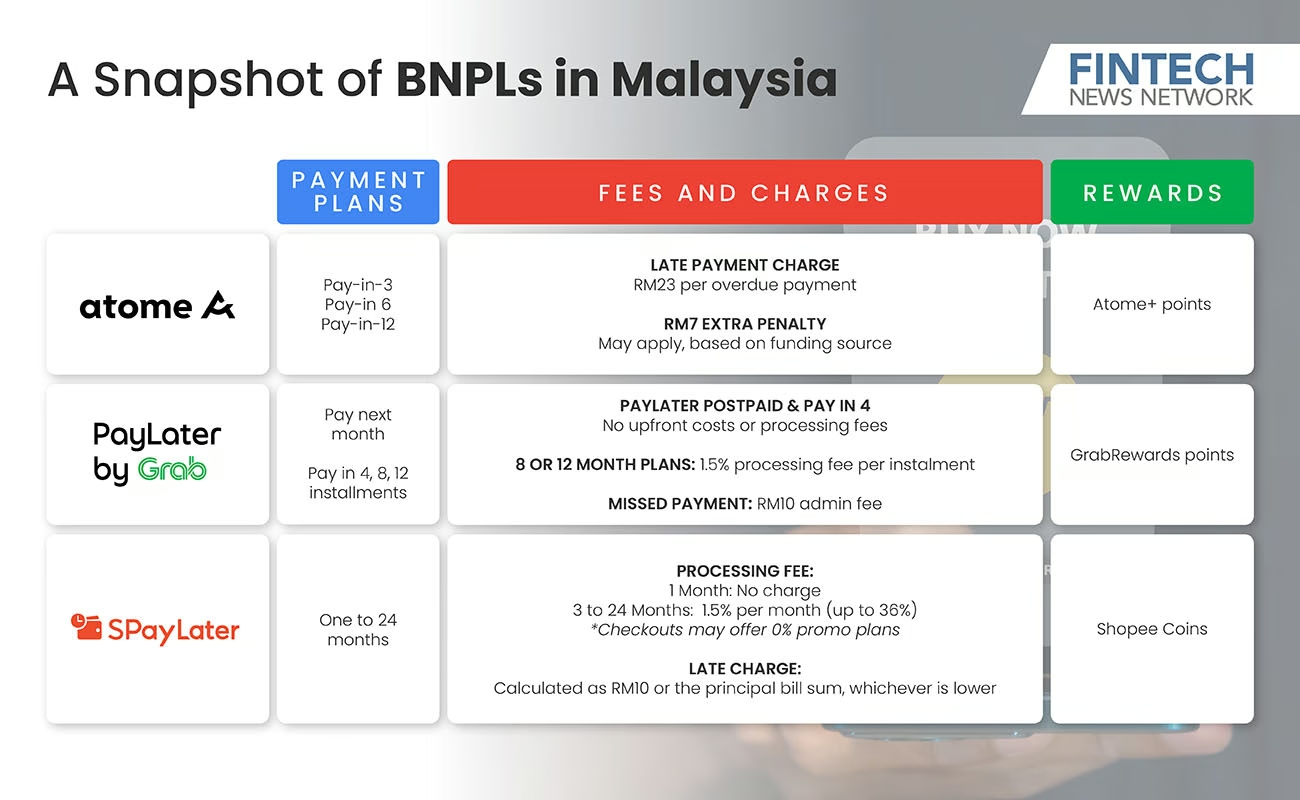

At the national level, Buy-Now-Pay-Later (BNPL) platforms have become a dominant trend in payments.

It has made borrowing easier for young people with limited financial experience.

When combined with slow wage growth and rising expenses, this access often drives young adults to borrow just to make ends meet.

Sarawak reflects similar financial behaviour patterns seen nationwide.

With more youth gravitating toward cities such as Kuching, Miri, and Bintulu, they encounter greater access to digital credit and consumer trends.

Without sufficient financial awareness, the mix of instant credit and peer influence can easily lead to overborrowing.

Understanding the Causes

Across Sarawak, a mix of technological and social factors is driving greater debt exposure among young people.

Firstly, the rapid expansion of digital financial services has made borrowing more convenient and accessible.

From mobile loan applications to Buy-Now-Pay-Later (BNPL) platforms, borrowing now takes only a few taps on a screen.

However, many users underestimate how multiple small instalments across platforms can accumulate into significant monthly commitments.

Secondly, behavioural patterns contribute significantly to the issue.

The Credit Counselling and Debt Management Agency (AKPK) found that poor spending control, weak saving habits, and limited financial planning are prevalent among young people.

Thirdly, economic conditions exacerbate these risks.

The Department of Statistics Malaysia (DoSM) recorded a youth unemployment rate of approximately 10.6% in 2023, surpassing the national rate.

With living costs rising and income growth stagnant, credit has become a coping mechanism rather than a financial tool for advancement.

Finally, financial literacy remains a major concern.

Although financial literacy is part of the national curriculum, its delivery often remains theoretical, with little emphasis on practical tools like budgeting or managing credit.

According to the OECD (2020), it emphasises that genuine financial competence develops through continuous, hands-on learning sustained over multiple years.

Comparisons: National, ASEAN, and Global

At the national level, Malaysia’s financial-literacy rate remains unchanged in 2024, with the Malaysia Financial Literacy and Capability (MYFLIC) Index score at 59.1%, only a 0.1% difference from 2021, according to Bank Negara’s demand-side survey.

Though this places Malaysia ahead of some regional counterparts, it underscores the need to strengthen financial understanding among youth.

Across the region, ASEAN countries are moving forward with digital financial-literacy plans coordinated through the ASEAN Financial Literacy Working Committee.

Singapore, Indonesia, and Thailand, for example, have integrated elements of fintech awareness and consumer rights into their education policies.

However, while Malaysia performs strongly in terms of inclusion, it continues to face behavioural hurdles comparable to its regional peers.

At the global level, countries such as Australia and Japan illustrate the positive outcomes of sustained youth engagement

Their school-based money-management modules have yielded tangible improvements in financial decision-making.

Sarawak could benefit from adopting and localising similar approaches through coordinated state and federal initiatives.

Stakeholders and Their Roles

Ensuring youth are financially resilient is not the work of one party alone, but a collective effort involving multiple stakeholders:

– The Sarawak Government: Embeds financial-literacy initiatives within school curricula and higher-learning programmes to nurture informed financial behaviour from an early age.

– Federal Regulators: Including Bank Negara Malaysia, and the Insolvency Department, shape consumer-credit policies, regulate BNPL, and personal-loan markets, and monitor household debt trends.

– Educational Institutions: At both secondary and tertiary level, reinforce foundation through structured lessons and hands-on financial exercises that promote responsible habits early on.

– Financial Institutions and fintech providers: Promotes responsible innovation by ensuring product transparency, affordability assessments, and ongoing consumer-education initiatives.

‘– Civil-society organisations, including AKPK: Supports national goals by conducting debt-counselling, literacy campaigns, and peer-learning sessions within communities.

‘- Families and local communities: Nurture early financial discipline, teaching youth the values of saving, delayed gratification, and responsible spending.

Successful Interventions and Lessons for the Future

Malaysia has introduced a range of financial-literacy initiatives that are beginning to show positive impact.

Through the AKPK “Train-the-Trainers” initiative, educators and community representatives are trained to deliver engaging lessons on personal finance.

On the other hand, the School Adoption Programme introduces budgeting and goal-setting exercises for secondary students.

At the national level, the Financial Education Network (FEN) spearheaded by Bank Negara Malaysia coordinates inter-agency efforts to embed financial education throughout life stages.

Early evaluations highlight improved savings behaviour and financial confidence among participants.

For Sarawak, enhancing these models through locally tailored initiatives could make a lasting difference—for instance, by requiring financial-literacy completion before releasing scholarship or entrepreneurship funds, promoting sustainable “learn first, earn later” culture.

Recommendation(s)

Sarawak holds a unique advantage in championing youth financial empowerment.

The following measures could reinforce its leadership role:

– Bring financial literacy to life in classrooms: by teaching students how to plan budgets understand credit, and protect themselves in digital-finance environments.

– Tie financial education to opportunity: by embedding it as a prerequisite for the release of state scholarships, study loans, or business grants.

– Create a central digital hub for youth: a digital platform offering personal-finance tracking tools, educational resources, and access to counselling services.

– Work with Fintech innovators: to implement affordability screening for borrowers under 30, incorporating consolidated BNPL statements, spending summaries, and built-in cooling-off periods.

– Establish a robust monitoring and evaluation system: to measure knowledge improvements, saving and spending patterns, and debt outcomes annually—ensuring transparency and policy refinement over time.

Conclusion

Young Sarawakians deserve the opportunity to live free from the weight of unmanageable debt.

Financial literacy, while not a cure-all, is an essential public asset that underpins economic participation.

Therefore, when paired with education, counselling, and responsible financial systems—backed by strong political will—it equips young people to make informed choices and build lasting prosperity.

With the Premier’s message of prudence and the state’s strategic investment in human capital, Sarawak is well-positioned to initiate targeted, data-driven programmes that translate financial knowledge into measurable, long-term resilience.

References:

- OECD/INFE 2020 International Survey of Adult Financial Literacy

- A Total of 5,272 Youths Declared Bankrupt Since 2020

- Financial Capability and Inclusion Demand Side Survey 2024

- Labour Force Statistics Report

- AKPK – Advancing Prudent Financial Behaviour

- Getting into Debt at a Young Age as Part of a Lifecycle Phase: A Cause for Concern